Audi Q3 Sportback Price in Delhi

Audi Q3 Sportback price in Delhi starts at ₹54.22 lakh*. The lowest price variant is Audi Q3 Sportback Technology. Check the December 2024 offers/deals on Audi Q3 Sportback Delhi and book a test drive now.

Audi Q3 Sportback On Road Price in Delhi,Delhi

Get On-Road Car Price of Audi Q3 Sportback in Delhi. On-road price of a car includes the ex-showroom price of the car in the city, road tax, insurance & handling charges etc.

| Ex-Showroom Price | ₹54,22,000 |

| TCS | ₹54,220 |

| Road Tax | ₹5,42,200 |

| Additional | ₹4,000 |

| Registration Charges | ₹600 |

| FASTag | ₹600 |

| Hypothecation Endorsement | ₹1,500 |

| Road Safety Cess | ₹9,760 |

| Other Charges | ₹400 |

| Insurance | ₹2,71,100 |

| On-Road Price in Delhi: | ₹63,06,380 |

Calculate how much you may have to pay every month for your car loan with V3Cars interactive auto loan EMI calculator. You will get car loan EMI as soon as you enter the required loan amount, the interest rate and the desired tenure period. Installment in EMI calculator is calculated on reducing balance.

FAQs

Calculating the on-road price of a car in India involves adding various costs and taxes to the base price of the vehicle. On-road price is the total cost you have to spend to drive the car legally on Indian roads. Here are the steps to calculate the on-road price of a car in India:

Base Price: Start with the base price of the car. This is the manufacturer's suggested retail price (MSRP) or ex-showroom price. You can find it on the manufacturer's website, at the dealership, or in advertisements.

Road Toll: Road tax varies from state to state in India. You can find the road tax rate of your state on the website of the transport department of the respective state. Calculate road tax as a percentage of the showroom price of the car. The formula is:

Road Tax = (Percentage of Road Tax / 100) * Ex-Showroom Price

Registration Fee: To register a car at the Regional Transport Office (RTO), a registration fee has to be paid. Rates vary depending on vehicle cost, location, and other factors. You can usually find details of registration fees on the RTO website or by visiting the RTO office.

Insurance: Car insurance is mandatory in India. The cost of insurance depends on factors such as the model of the car, its age, its location, and the type of insurance (comprehensive or third-party). Contact insurance providers or use online tools to get insurance quotes.

Management and Logistics Fees: Dealers may charge handling and logistics charges for delivering the car to you. These rates may vary from dealer to dealer, so check with the specific dealer.

Additional Accessories: If you plan to add optional accessories or features to your car, such as alloy wheels, an audio system, or custom upholstery, include the cost of these in your calculations.

GST (Goods and Services Tax): GST is applicable on the ex-showroom price of the car and the rate depends on the type and size of the vehicle. Check the GST rate on the official GST portal.

Fastag and Other Charges: Please note the charges like Fastag fee, handling fee, and any other applicable charges.

Optional Extended Warranty: If you choose to purchase an extended warranty for your car, include this cost in your calculations.

Total On-Road Price: Add all the above components to get the total on-road price:

On Road Price = Base Price + Road Tax + Registration Fees + Insurance + Handling & Logistics Charges + Additional Accessories + GST + FASTag + Other Charges + Optional Extended Warranty

Please remember that on-road prices may also include other local taxes or levies, which may vary by location and may change over time. When calculating the on-road price of a car in India it is essential to verify all these costs with the car dealer and consult the concerned state transport department for the most accurate and latest information.

The main difference between the showroom price and the on-road price of a vehicle lies in the components included in the price and the taxes and charges associated with purchasing the vehicle. Here are details of each:

Ex-showroom Price: Ex-showroom price is the base price of the vehicle set by the manufacturer or dealer. This covers the cost of the vehicle itself, including manufacturing costs, the dealer's profit margin, and any accessories or extra features that come with the vehicle.

This price does not include taxes, registration fees, insurance, or other additional costs associated with owning and running the vehicle.

On-Road Price: On-road price is the total cost you will have to spend to purchase the vehicle and drive it legally on the road. This ex-showroom price includes other miscellaneous charges and taxes:

- Registration Fee: The cost of registering the vehicle at the local Regional Transport Office (RTO).

- Circulation Tax: A tax charged by the state government for the use of a vehicle on public roads.

- Insurance: Cost of vehicle insurance, which includes mandatory third-party insurance and optional comprehensive insurance.

- Handling Charges: Dealers may add handling or logistics charges for delivery of the vehicle.

- Additional Accessories: If you choose to add additional features or accessories to the vehicle, these are included in the price of the trip.

- State-specific Taxes: Some states or regions of a country may impose additional taxes or levies. Any other local or state-specific fees.

On-road price is the final amount you need to pay to purchase the vehicle and get it legally on the road. It is important to consider on-road price when budgeting for a new vehicle, as it can significantly impact the overall cost of ownership. Additionally, on-road prices may vary from location to location due to differences in taxes and duties imposed by different states or territories.

When purchasing a vehicle it is a good practice to consult the dealership or check the manufacturer's official website or your local RTO to understand the specific factors that make up the on-road price in your area. This will help you plan your budget more accurately and avoid surprises when shopping.

SUV

Body Type0.00 kmpl

Mileage1498 cc

EngineAutomatic

TransmissionPetrol

Fuel Type5 Seater

Seat CapacityAudi Q3 Sportback Related Videos

Audi Q3 Sportback Related News

Audi India Records 89% Growth in 2023: 7931 Units Sold (Press Release)

Audi India reported an 89% growth in 2023, selling 7,931 units, fueled by 3 new launches...

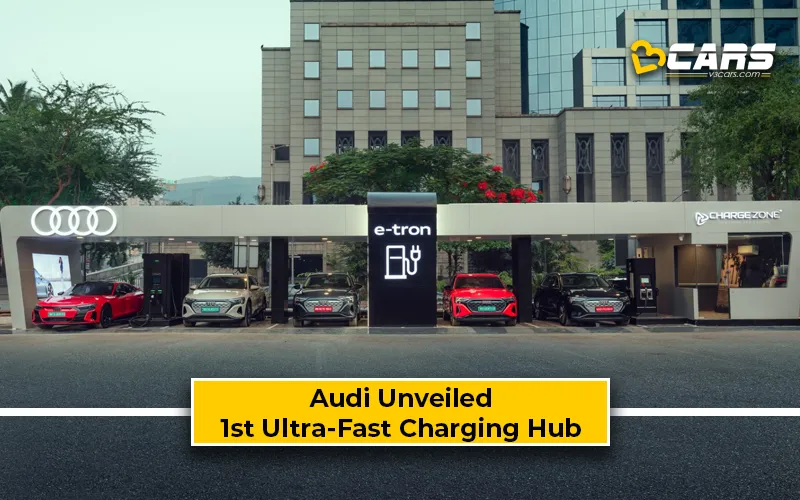

Audi Unveiled India's 1st Ultra-Fast Charging Hub in Mumbai (Press Release)

Audi inaugurated India's first ultra-fast charging station in Mumbai's Bandra...

Audi Car Owners In Chennai Get Free Roadside Assistance During Floods

Audi has today declared the provision of complimentary Roadside Assistance (RSA) for its...

Audi India Set To Hike Car Prices On 1 January, 2024 (Press Release)

Audi India have announced a price increase of up to 2% across its model range owing to...

Audi India Announce 10-Year RSA On All Cars Sold From October 1 (Press Release)

Audi India have announced a 10-year roadside assistance program on all cars sold from...

25th Audi Approved Plus Dealership Inaugurated In Bangalore (Press Release)

Audi India recently inaugurated their 25th Approved Plus dealership in Bangalore,...

Audi India Open Approved Plus Dealership In Noida

Audi India have expanded their pre-owned car business by opening a new dealership in...

Audi Q3, Q3 Sportback Local Production Begins

Audi India have commenced local production of their entry level SUV range, which includes...

Audi India Open A New 3S Dealership In Raipur

Audi India have expanded their network with a new 3S dealership in Raipur, Chhattisgarh....

Audi India Registers 126% YoY Jump In Q1 2023 Sales (Press Release)

Audi India reported strong sales figures for the first quarter of 2023 with 1,950 new cars...

Audi India To Hike The Prices Of Their Select Models From May 2023

Audi, the German luxury car manufacturer, recently announced that they will raise prices...

Audi Q3 Sportback S Line Coupe SUV Launched At Rs. 51.43 Lakh

Audi India have launched the Q3 Sportback in India at a price of Rs. 51.43 lakh...

Audi Q3 Sportback Bookings Open

After launching the Audi Q3, the carmaker has announced plans to launch the Q3 Sportback...

Electric Vehicles - Pros And Cons

As you already know that the international community is pushing for alternative fuels to...

Audi India Launch Club Rewards For Audi Customers

Audi India have launched a club rewards program in India. Under this programme, all Audi...

Popular Models

FAQs

Calculating the on-road price of a car in India involves adding various costs and taxes to the base price of the vehicle. On-road price is the total cost you have to spend to drive the car legally on Indian roads. Here are the steps to calculate the on-road price of a car in India:

Base Price: Start with the base price of the car. This is the manufacturer's suggested retail price (MSRP) or ex-showroom price. You can find it on the manufacturer's website, at the dealership, or in advertisements.

Road Toll: Road tax varies from state to state in India. You can find the road tax rate of your state on the website of the transport department of the respective state. Calculate road tax as a percentage of the showroom price of the car. The formula is:

Road Tax = (Percentage of Road Tax / 100) * Ex-Showroom Price

Registration Fee: To register a car at the Regional Transport Office (RTO), a registration fee has to be paid. Rates vary depending on vehicle cost, location, and other factors. You can usually find details of registration fees on the RTO website or by visiting the RTO office.

Insurance: Car insurance is mandatory in India. The cost of insurance depends on factors such as the model of the car, its age, its location, and the type of insurance (comprehensive or third-party). Contact insurance providers or use online tools to get insurance quotes.

Management and Logistics Fees: Dealers may charge handling and logistics charges for delivering the car to you. These rates may vary from dealer to dealer, so check with the specific dealer.

Additional Accessories: If you plan to add optional accessories or features to your car, such as alloy wheels, an audio system, or custom upholstery, include the cost of these in your calculations.

GST (Goods and Services Tax): GST is applicable on the ex-showroom price of the car and the rate depends on the type and size of the vehicle. Check the GST rate on the official GST portal.

Fastag and Other Charges: Please note the charges like Fastag fee, handling fee, and any other applicable charges.

Optional Extended Warranty: If you choose to purchase an extended warranty for your car, include this cost in your calculations.

Total On-Road Price: Add all the above components to get the total on-road price:

On Road Price = Base Price + Road Tax + Registration Fees + Insurance + Handling & Logistics Charges + Additional Accessories + GST + FASTag + Other Charges + Optional Extended Warranty

Please remember that on-road prices may also include other local taxes or levies, which may vary by location and may change over time. When calculating the on-road price of a car in India it is essential to verify all these costs with the car dealer and consult the concerned state transport department for the most accurate and latest information.

The main difference between the showroom price and the on-road price of a vehicle lies in the components included in the price and the taxes and charges associated with purchasing the vehicle. Here are details of each:

Ex-showroom Price: Ex-showroom price is the base price of the vehicle set by the manufacturer or dealer. This covers the cost of the vehicle itself, including manufacturing costs, the dealer's profit margin, and any accessories or extra features that come with the vehicle.

This price does not include taxes, registration fees, insurance, or other additional costs associated with owning and running the vehicle.

On-Road Price: On-road price is the total cost you will have to spend to purchase the vehicle and drive it legally on the road. This ex-showroom price includes other miscellaneous charges and taxes:

- Registration Fee: The cost of registering the vehicle at the local Regional Transport Office (RTO).

- Circulation Tax: A tax charged by the state government for the use of a vehicle on public roads.

- Insurance: Cost of vehicle insurance, which includes mandatory third-party insurance and optional comprehensive insurance.

- Handling Charges: Dealers may add handling or logistics charges for delivery of the vehicle.

- Additional Accessories: If you choose to add additional features or accessories to the vehicle, these are included in the price of the trip.

- State-specific Taxes: Some states or regions of a country may impose additional taxes or levies. Any other local or state-specific fees.

On-road price is the final amount you need to pay to purchase the vehicle and get it legally on the road. It is important to consider on-road price when budgeting for a new vehicle, as it can significantly impact the overall cost of ownership. Additionally, on-road prices may vary from location to location due to differences in taxes and duties imposed by different states or territories.

When purchasing a vehicle it is a good practice to consult the dealership or check the manufacturer's official website or your local RTO to understand the specific factors that make up the on-road price in your area. This will help you plan your budget more accurately and avoid surprises when shopping.